42 how to calculate a bond's coupon rate

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

What Is a Coupon Rate? How To Calculate Them & What They're Used For Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%. Therefore, it pays $200 every year no matter what ...

How to calculate a bond's coupon rate

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

How to calculate a bond's coupon rate. Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In addition, the discount rate used to calculate the bond's price increases. For these two reasons, the bond's price ... Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. Coupon Rate Calculator | Solution Step by Step 🥇 How to calculate the coupon rate? - Formula. The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage ... Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

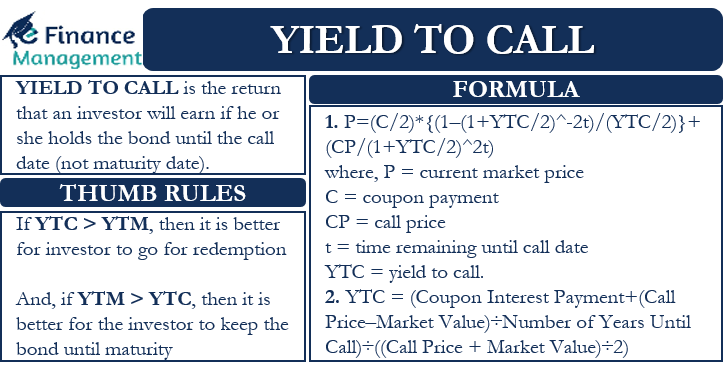

Coupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments by the par value of the bonds and multiplying the resultant with the 100. ... This occurs when a bond's coupon rate surpasses its prevailing ... Internal Rate of Return (IRR) Rule: Definition and Example Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ... How To Find Coupon Rate Of A Bond On Financial Calculator The current bond price and coupon rate calculate the bond's yield to maturity. How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay ... Bond Yield Calculator | Calculate Bond Returns Calculate the bond yield. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at the same interest rate. Hence, the bond yield formula involves deducing the bond yield r in the equation below: bond price = Σ k=1n [cf / (1 + r) k], where.

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · The minimum expectation is based on the bond’s credit rating, and the interest rate paid by bonds of similar quality. Assume that you decide on a 4% discount rate for the $100 payment due in 5 years. The discount rate is used to discount (reduce) the value of your future payments into today’s dollars.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. $ 36, 798 / $ 500, 000 = .073596 {\displaystyle \$36,798/\$500,000=.073596}

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Post a Comment for "42 how to calculate a bond's coupon rate"